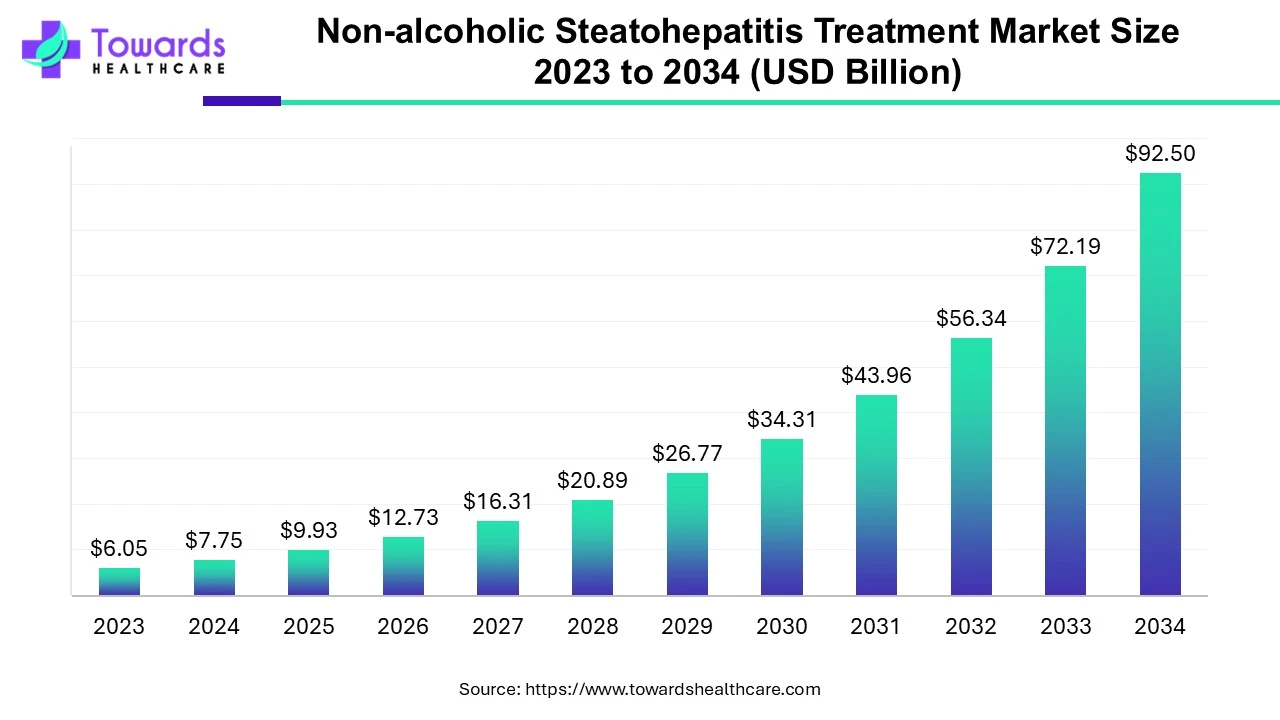

Non-alcoholic Steatohepatitis Treatment Market Booms at 28.14% CAGR by 2034

The non-alcoholic steatohepatitis treatment market size is calculated at USD 9.93 billion in 2025 and is expected to reach around USD 92.5 billion by 2034, growing at a CAGR of 28.14% for the forecasted period.

Ottawa, Sept. 22, 2025 (GLOBE NEWSWIRE) -- The global non-alcoholic steatohepatitis treatment market size was valued at USD 7.75 billion in 2024 and is predicted to hit around USD 92.5 billion by 2034, rising at a 28.14% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising due to the surging global prevalence of obesity, type 2 diabetes, and metabolic disorders, coupled with increasing approvals of innovative and effective therapies.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5409

Key Takeaways:

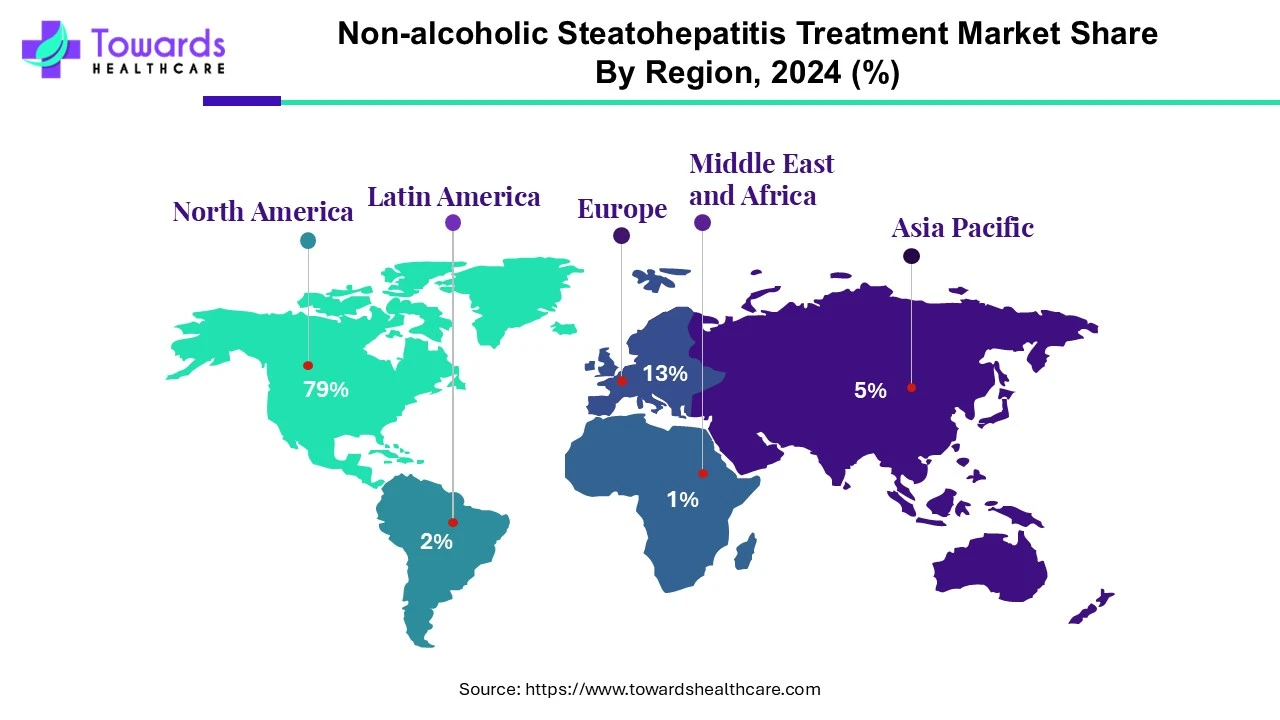

- North America dominated the global non-alcoholic steatohepatitis treatment market share by 79% in 2024.

- Asia-Pacific is projected to host the fastest-growing market in the coming years.

- By drug, the vitamin E & pioglitazone segment held a dominant presence in the market in 2024.

- By drug, the semaglutide segment is estimated to show lucrative growth in the market during the forecast period.

- By disease stage, the NASH stage F1 segment held the largest share in the non-alcoholic steatohepatitis treatment market in 2024.

- By disease stage, the NASH stage F0 segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By distribution channel, the hospital pharmacies segment led the global market in 2024.

- By distribution channel, the retail & pharmacies segment is predicted to witness significant growth in the market over the forecast period.

Market Overview:

Non-alcoholic steatohepatitis (NASH), increasingly being referred to as metabolic dysfunction-associated steatohepatitis (MASH), is a concerning progression of non-alcoholic fatty liver disease (NAFLD), involving liver inflammation and fibrosis, and can even progress to cirrhosis or hepatocellular carcinoma.

This development has occurred alongside a growing global prevalence of obesity, type 2 diabetes, metabolic syndrome, and sedentary lifestyles, with improved methods of screening, diagnosis, and approval for promising pharmacologic therapies coming to market.

The therapeutic segments, disease-state segments, and channels of distribution show differential patterns of dominance and growth. While North America is already dominated by disease prevalence, Asia-Pacific is recognized as the fastest growing unit, with increasing disease and burden, alongside improved health care utilization.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

- Increasing prevalence of metabolic dysfunction: As obesity, insulin resistance, and the prevalence of type 2 diabetes continues to increase around the world, more people will be at risk of NAFLD progressing to NASH. Lifestyle change, urbanization, and population aging are contributory factors.

- Regulatory traction & approvals: Recent drugs such as semaglutide (Wegovy) approved by the FDA for MASH with fibrosis have validated the clinical efficacy of drugs, resulting in increased confidence by patients, providers, and investors. Regulatory approval is a clear signal that we can develop effective drugs.

- Expanded diagnostic approaches & earlier case finding: Non-invasive diagnostics, biomarkers, imaging advancements, and screening programs are leading to earlier disease being identified, thus expanding the treatable population. Earlier case finding is typically more cost-effective and associated with better treatment outcomes.

- Strong product pipeline & drug innovation: New classes of drugs are moving through late-phase clinical trials. This gives promise of even safer and more efficacious treatments.

-

Increasing awareness & increasing investments in healthcare: Patients, providers, and payers understand NASH/MASH is a serious disease that should be treated. In addition, the continued investment in healthcare infrastructure is increasing in emerging populations, which will facilitate access to treatments.

Key Drifts:

Medications such as semaglutide are no longer solely indicated for diabetes or weight management, as studies and indications emerge for their use in reducing liver inflammation and fibrosis in NASH/MASH. Increasingly there is a focus on treating the earlier stages of disease rather than waiting until individuals reach advanced fibrosis. This trend is associated with decreasing bellwether long-term complications, reduced costs, and increased quality of life for patients.

As more expensive therapies are made available, increased pressure for affordable therapies is coming primarily from Asia Pacific and other regions. Licensed copies and generics of GLP-1 inhibitors are already entering various regions. NASH is complex (including metabolic, inflammatory, and fibrotic pathways), research is moving toward combination therapies, dual agonists, to affect many different pathways and powerful adjuncts that are non-pharmacologic.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

Drugs that act on metabolic/inflammatory/fibrotic pathways may cause side effects. There is often a lack of long-term safety data for these drugs, which slows down the regulatory approval and product uptake by clinicians. Physicians and patients want assurance of safety prior to starting a chronic, long-term treatment. New therapies, such as GLP-1 based drugs or agonists are often very costly.

Obtaining reimbursement through insurance companies and for those nations with national health systems and public healthcare, ultimately through the public system is always a challenge, particularly in lower income nations. Patients often cannot afford or access these new therapies. Complicated clinical trials & slower pace of disease progression: Outside of trial medicines, NASH progress is slow and is variable. Trials thus need to last for long durations, attempt to enrol hundreds and thousands of patients, and use invasive, cumbersome, or expensive endpoints.

This also adds cost and time. Regulatory agencies may also be asking for histological endpoints or extensive histological biomarker validation. Many patients in the early stage of the disease are asymptomatic; there is no consistent screening process. In the absence of an early diagnosis, we may lose the opportunity to intervene and will limit the market uptake of early-stage therapies.

Regional Analysis:

North America has the largest share of the NASH/MASH treatment market by 79% segment. The region is home to advanced healthcare infrastructure and regulatory system stability, high levels of awareness in regard to disease prevalence and burden on patients, and has made significant investments in research and development. North America continues to be the leader in terms of revenue and in terms of new drugs receiving early approvals in the NASH/MASH treatment space

The Asia-Pacific region is set to be the fastest growing region over the study's forecast period. Factors influencing the growth of the segment include large patient cohorts in China, India, southeast Asia that is 'growing' at a rapid pace, rising obesity rates, increased diabetes prevalence, improved diagnostic and healthcare infrastructures, and increased focus of global and regional pharmaceutical companies on treatments for NASH/MASH. Initiatives, also, within government for preventative care or screening would accelerate this pathogeny and influences to some extent.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By drug:

The Vitamin E and Pioglitazone class of drugs leads the market. The class has been established as having efficacy in reducing liver enzymes and improving histopathology related to NASH in many patients, is inexpensive, and has been adopted first with global access, thus leads the class segmentation.

On the other hand, the current fastest growing pharmacological class in this forecast period is Semaglutide. GLP-1 receptor agonists are a growth area due to a recent FDA accelerated approval for use with NASH and, therefore, proven efficacy in both resolution of steatohepatitis and improvement in fibrosis as well as reduction in weight and positive metabolic outcomes that improve the upstream drivers.

By Disease Stage:

The NASH Stage F1 stage is leading the disease stage segmentation. F1 stage patients have easily visible symptoms or discovered incidentally through screening, and more patients may be diagnosed with F1 than with later, more active disease. The treatment guidelines also typically encourage treating F1 patients, and there is an assumption that interventions can prevent significant disease progression.

The fastest growing segment in the forecast period is NASH Stage F0 (no fibrosis, fatty liver changes only). Increased screening, non-invasive diagnostics, awareness campaigns, and preventive strategies are allowing earlier detection, thereby increasing demand for treatments or interventions even before fibrosis begins, in order to avoid disease progression.

By Distribution Channel

The Hospital Pharmacies segment currently leads distribution. Many new or prescription-only treatments are first used in a hospital setting with the availability of specialists, medications, histology-based diagnosis, and monitoring. Hospitals are still the primary channel for clinicians treating moderate to advanced disease.

Conversely, the Retail & Specialty Pharmacies segment is the fastest growing channel. The drivers behind the growth of the Retail & Specialty Pharmacies segment include increasing treatment availability in outpatient and community settings, patients' preference for convenience, initiatives aimed to improve drug affordability, and expanding networks of specialty pharmacies equipped to accommodate complex therapies with patient education.

Browse More Insights of Towards Healthcare:

The global heartworm treatment products market is valued at US$ 1.45 billion in 2024, growing to US$ 1.55 billion in 2025 and is expected to reach approximately US$ 2.85 billion by 2034, expanding at a CAGR of 7.04% between 2025 and 2034.

The progressive pulmonary fibrosis (PPF) treatment market is estimated at US$ 0.6 billion in 2024, rising to US$ 0.69 billion in 2025, and projected to hit around US$ 2.45 billion by 2034, growing at a strong CAGR of 15.21% over the forecast period.

The bronchitis treatment market is valued at US$ 6.85 billion in 2024, increasing to US$ 7.21 billion in 2025, and is expected to reach US$ 11.45 billion by 2034, with a CAGR of 5.28%.

The rare disease treatment market stands at US$ 195.21 billion in 2024, growing to US$ 217.93 billion in 2025, and is projected to reach nearly US$ 587.08 billion by 2034, expanding at a CAGR of 11.64%.

The chronic disease treatment market is valued at US$ 8.37 billion in 2024, increasing to US$ 9.74 billion in 2025, and is projected to reach US$ 38.02 billion by 2034, growing at a robust CAGR of 16.34%.

The cervical cancer treatment market is estimated at US$ 8.65 billion in 2024, rising to US$ 9.12 billion in 2025, and expected to reach US$ 14.68 billion by 2034, with a CAGR of 5.44%.

The dementia treatment market stands at US$ 18.09 billion in 2024, growing to US$ 19.54 billion in 2025, and projected to reach US$ 39.16 billion by 2034, at a CAGR of 8.03%.

The basal cell carcinoma treatment market is valued at US$ 3.33 billion in 2024, increasing to US$ 3.67 billion in 2025, and expected to reach US$ 9.01 billion by 2034, expanding at a CAGR of 10.48%.

The food allergy treatment market is estimated at US$ 6.9 billion in 2024, rising to US$ 7.47 billion in 2025, and projected to reach US$ 15.32 billion by 2034, growing at a CAGR of 8.3%.

The diabetic foot ulcer treatment market was valued at US$ 5.20 billion in 2023 and is forecasted to grow to US$ 9.84 billion by 2034, expanding at a CAGR of 6.04% from 2024 to 2034.

Recent Developments:

On August 15, 2025, Novo Nordisk’s Wegovy (semaglutide 2.4 mg) gained accelerated approval from the U.S. FDA for treatment of adults with noncirrhotic metabolic dysfunction-associated steatohepatitis (MASH) with moderate to advanced liver fibrosis.

Key Players List

- AstraZeneca

- Eli Lilly & Company

- Galectin Therapeutics

- Galmed Pharmaceuticals, Ltd.

- Intercept Pharmaceuticals

- Madrigal Pharmaceuticals

- Mayo Foundation for Medical Education & Research

- NGM Biopharmaceuticals

- Novo Nordisk A/S

- Pfizer, Inc.

- Shilpa Medicare

- Viking Therapeutics, Inc.

Segments Covered in the Report

By Drug

- Vitamin E & Pioglitazone

- Semaglutide

- Obeticholic Acid (OCA)

- Lanifibranor

- Resmetirom

- Aramchol

- Cenicriviroc

- Other Drugs

By Disease Stage

- NASH Stage F1

- NASH Stage F0

- NASH Stage F2

- NASH Stage F3

- NASH Stage F4

By Distribution Channel

- Hospital Pharmacies

- Retail & Specialty Pharmacies

- Other Pharmacies

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5409

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.