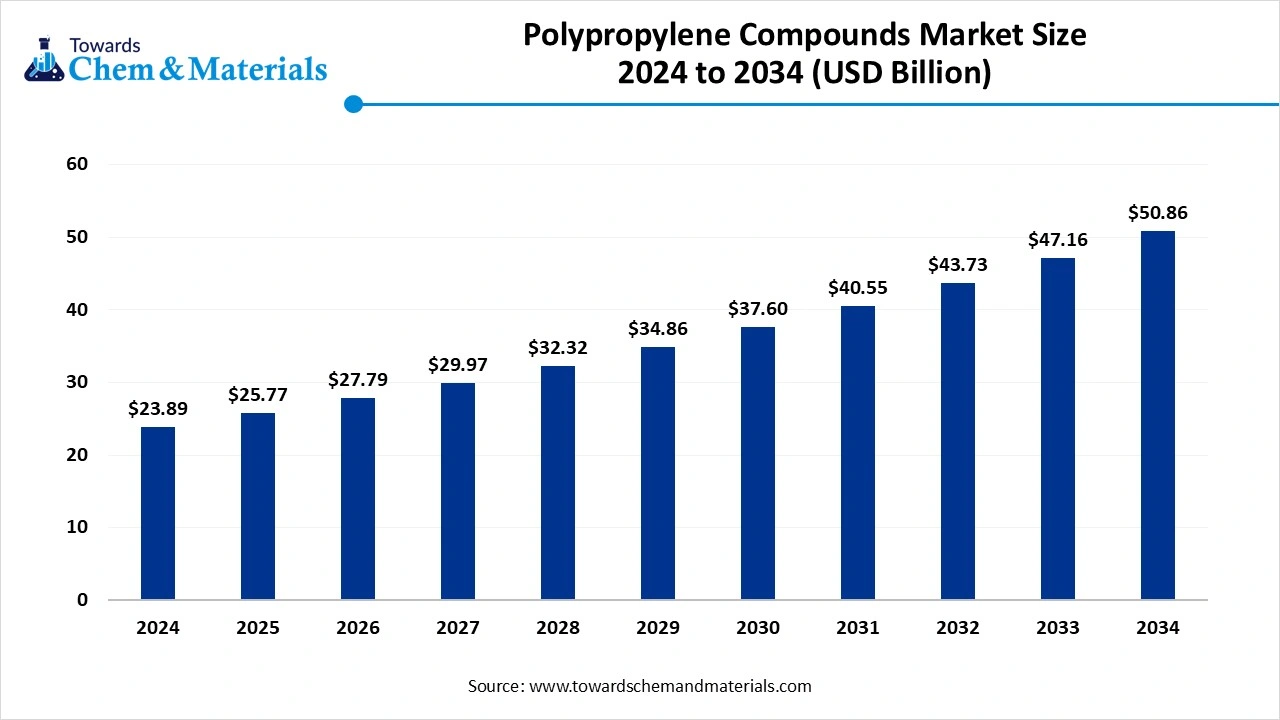

Polypropylene Compounds Market Size to Cross USD 50.86 Bn by 2034

According to Towards Chemical and Materials, the global polypropylene compounds market size is calculated at USD xx billion in 2025 and is expected to be worth around USD 50.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 25.77% over the forecast period 2025 to 2034.

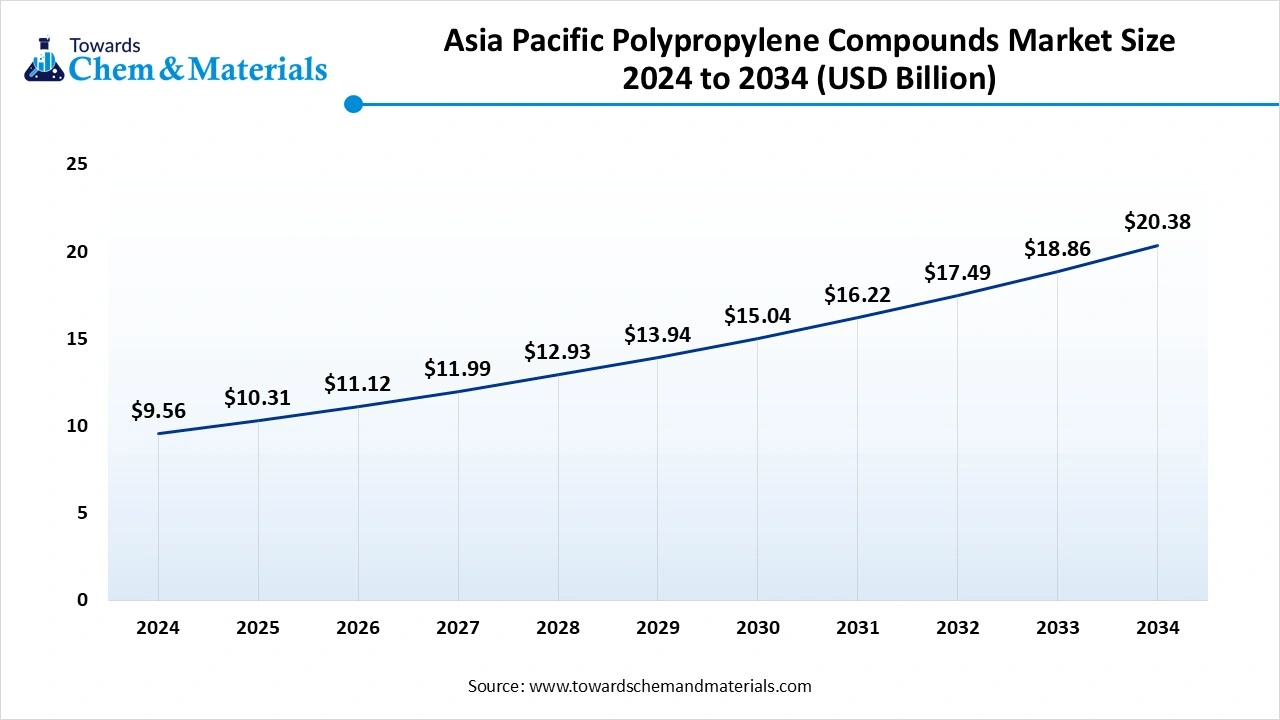

Ottawa, Oct. 20, 2025 (GLOBE NEWSWIRE) -- The global polypropylene compounds market size was valued at USD 23.89 billion in 2024 and is anticipated to reach around USD 50.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 25.77% over the forecast period from 2025 to 2034. Asia Pacific dominated the polypropylene compounds market with a market share of 40% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5893

Polypropylene Compounds Overview

The polypropylene compounds market is evolving as industries intensify demand for lightweight, durable, and cost-effective materials that offer chemical resistance and thermal stability, with growth fuelled by expansion in automotive, packaging, construction, and electronics sectors in emerging economies, manufacturers are increasingly focusing on specialty compound formulations and process innovations to meet performance and sustainability needs, while regional dynamics favour strong uptake in Asia Pacific due to industrialization and investment in infrastructure, and innovation trends emphasize enhanced filler systems, property customization, and optimized processing routes to drive differentiation and value growth in the competitive landscape.

Polypropylene Compounds Market Report Highlights

- By region, Asia Pacific dominated the market with a 40% industry share in 2024.

- By propylene type, the homopolymer segment led the market with 65% industry share in 2024.

- By application type, the automotive segment emerged as the top-performing segment in the market with 35% industry share in 2024.

- By property type, the impact-resistant segment led the market with a 50% share in 2024.

- By process technology, the injection molding segment emerged as the top-performing segment in the market with 45% industry share in 2024.

Properties of Polypropylene compounds

Polypropylene (PP) is the commodity thermoplastic with the lowest density. With lower density, parts are molded with lower weight. Other typical properties of Polypropylene is that it is tough and flexible, especially when copolymerized with ethylene. This allows polypropylene compounds to be used as an engineering thermoplastic, competing with materials such as acrylonitrile butadiene styrene (ABS). Polypropylene is at room temperature resistant to fats and almost all organic solvents, apart from strong oxidants. Non-oxidizing acids and bases can be stored in containers made of PP. Polypropylene is recyclable and has the number “5” as its resin identification code.

Structure and Behavior of Polypropylene Compounds

Polypropylene compound shares similarities with polyethylene, particularly in solution behavior and electrical characteristics. However, the presence of methyl groups in polypropylene enhances its mechanical strength and thermal resistance, albeit at the expense of reduced chemical resistance. In isotactic polypropylene, the methyl groups are aligned on one side of the carbon backbone, resulting in higher crystallinity. This configuration makes it firmer and more resistant to creep compared to atactic polypropylene and polyethylene.

Introduction to Polypropylene (PP)

Polypropylene (PP) belongs to the polyolefin family and is among the three most widely used thermoplastics globally. PP compounds are utilized across many applications, such as:

- Automotive industry

- Industrial applications

- Consumer goods

- Furniture and household products

One notable advantage of PP is its low density, the lowest among commodity plastics.

Polypropylene Polymer Structures

Based on the spatial arrangement of methyl groups (CH₃) on the polymer chain, polypropylene is classified into:

- Atactic PP: Irregular methyl group arrangement

- Isotactic PP: Methyl groups aligned on one side of the chain

-

Syndiotactic PP: Alternating methyl group arrangement

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3900) https://www.towardschemandmaterials.com/checkout/5893

Polypropylene Compounds Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 27.79 billion |

| Revenue forecast in 2034 | USD 50.86 billion |

| Growth rate | CAGR of 7.85% from 2024 to 2034 |

| Base year for estimation | 2023 |

| Historical data | 2021 - 2024 |

| Forecast period | 2024 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type of Polypropylene, By Application, By Property, By Process Technology, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key companies profiled | Mitsui Chemical, Inc.; IRPC Public Company Limited; Exxon Mobil Corporation; Avient Corporation; Japan Polypropylene Corporation; SABIC; Trinseo S.A.; Sumitomo Chemical Co., Ltd.; Washington Penn; Borealis AG; LyondellBasell Industries Holdings B.V.; DAEHACOM Co., Ltd.; GS Caltex Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Types of Polypropylene Compounds

1. Homopolymer Polypropylene

This is the most commonly used grade and consists of only propylene monomers. It has a semi-crystalline structure and is widely used in:

- Packaging

- Textiles

- Healthcare products

- Piping systems

- Automotive parts

- Electrical insulation

2. Copolymer Polypropylene

There are two main subtypes of copolymers:

- Random Copolymer PP: Produced by copolymerizing ethylene and propylene, with ethylene units randomly distributed (up to 6%). These PP compounds are flexible and optically transparent, ideal for transparent applications or products requiring aesthetic appeal.

- Block Copolymer PP: Contains a higher ethylene content (5–15%) arranged in regular blocks. These compounds offer higher strength but are less flexible, making them suitable for structural and industrial uses.

PP copolymers are commonly used in:

- Packaging

- Home appliances

- Pipes and films

- Electrical components

- Automotive applications requiring impact resistance

3. Terpolymer Polypropylene

Terpolymers consist of propylene, ethylene, and butene units randomly distributed along the chain. These poly propylene compounds exhibit enhanced clarity and reduced crystallinity, making them ideal for sealing films and transparent packaging.

4. High Melt Strength Polypropylene (HMS PP)

HMS PP is modified to include long-chain branching, offering high melt strength and melt phase elasticity. These PP compounds feature:

- Excellent foamability

- Good chemical resistance

- High thermal stability

They are widely used in:

- Food packaging foams

- Automotive components

- Construction materials

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3900) https://www.towardschemandmaterials.com/checkout/5893

Here Are Some Of The Top Products In The Polypropylene Compounds Market

- Mineral-filled PP compounds — The largest product segment. Adding minerals (talc, calcium carbonate, mica, etc.) boosts stiffness, heat distortion temperature, dimensional stability. Widely used in automotive interiors/exteriors, appliances, construction.

- Glass fibre reinforced PP — Offers higher strength, stiffness, and thermal resistance compared to unreinforced PP. Growing fast, especially for structural and under-the-hood automotive parts.

- PP-based TPO compounds (Thermoplastic Olefin) — Blends of PP, PE, and rubber (often EPDM). These provide good impact resistance, low temperature toughness, flexibility & chemical resistance. Used in automotive bumpers, exterior trims, roofing, and other rugged parts.

- PP-based TPV compounds (Thermoplastic Vulcanizates) — Similar to TPO but with more elastomeric/rubber content; better elasticity, vibration damping. Used in seals, weather strips, soft-touch components.

- Additive concentrated / masterbatch PP compounds — PP compounds with high loading of additives (UV stabilizers, flame retardants, antioxidants, colorants) made as concentrates; mixed into base PP. Useful for tailoring performance (flame retardancy, UV stability, color).

- Impact copolymer compounds — PP copolymers that have enhanced impact strength (by incorporating ethylene), especially at low temperatures. Useful for applications needing toughness (e.g. safety parts, housings).

- Random copolymer compounds — These have ethylene randomly distributed, giving better clarity, flexibility, lower haze. Often used for packaging, medical applications, components requiring aesthetics.

- Homopolymer PP compounds — Pure PP (no comonomer), high crystallinity, high stiffness, good chemical resistance. Widely used for load-bearing parts, rigid containers, structural elements.

- Talc-filled PP (a subtype of mineral filler) — Highly used mineral filler due to its plate-like structure; improves stiffness and heat distortion while retaining relatively low cost. Very common in automotive and appliance parts.

- “Others” / specialty PP compounds — This includes flame retardant PP, electro-conductive PP, PP with very high-temperature performance, PP blends to replace metals or engineering plastics. These niche/specialty grades are smaller in volume but growing in importance.

What Are The Major Trends In The Polypropylene Compounds Market?

- Increasing demand for lightweight materials in the automotive and packaging sectors is pushing manufacturers to use polypropylene compounds to replace heavier materials.

- Strong focus on sustainability, with more recycled blends and formulations designed to reduce carbon footprint becoming more common.

- Growth in specialty grades as industries require enhanced performance for exterior, outdoor, and demanding uses.

- Adoption of advanced process technologies, including AI-enabled reactive extrusion and localized small batch production to increase flexibility and reduce lead times.

- Regional expansion, specially in Asia Pacific, driven by infrastructure development, industrialization, and rising demand in end-use industries like automotive, electronics, and packaging.

How Does AI Influence The Growth Of The Polypropylene Compounds Market In 2025?

Artificial intelligence is influencing the growth of the polypropylene compounds market in industries. Through advanced data analytics and machine learning models, AI enables manufacturers to predict material behaviour, customize compound formulations for specific applications, and reduce trial and error in product development. In production, AI-driven automation improves process efficiency, enhances quality control, and minimizes waste by detecting defects in real time and adjusting processing conditions dynamically. It also supports predictive maintenance for machinery, lowering downtime and operational costs. On the sustainability side, AI side, AI aids in developing recycling pathways and optimizing the use of secondary raw materials, helping industries meet stricter environmental standards. By bridging innovation with efficiency, AI is accelerating the adoption of polypropylene compounds in diverse applications, from automotive lightweight Ning to high performance packaging and consumer goods.

Polypropylene Compounds Market Dynamics

Can AI Help Cut Production Waste In PP Compounds?

AI driven process optimization sift through sensor and operational data to fine tune reaction conditions, regulate temperature and pressure, and dynamically adjust feed rates thereby reducing scrap, minimizing off-spec output, and improving overall yield. The tighter control enabled by AI ensures that more of the raw propylene ends up as usable compounds, lowering per unit production costs and boosting margins.

Will AI boost Recyclability And Circular PP Use?

Ai systems enable more precise sorting of postconsumer polypropylene by grade and purity, allowing higher quality recycled feedstock’s to reenter compound manufacturing. This enhanced recovery and segregation thanks to AI contributes to circular economies for polypropylene compounds, increasing supply of recycled material, enhancing sustainability credentials, and supporting growth of eco-friendly compounds lines.

Market Opportunity

Could Recycled Food Grade PP Open New Packaging Paths?

Recent studied leveraging Ai systems at recycling facilities have uncovered that a large portion of recycled polypropylene captured is food grade material, enabling opportunities to reintroduce it into food packaging streams ad satisfy rising brand and regulatory demand for recycled content.

Might EV Growth Inlock Novel PP Compound Uses?

As the electric vehicle sector expands, material suppliers are experimenting with polypropylene compound formulations to serve thermal management, battery enclosures, and structural parts In EVs, creating fresh application niches.

Limitations In The Polypropylene Compounds Market

- Raw material price volatility impacts profitability and cost competitiveness for compound producers, as fluctuations in propylene or crude oil feedstock’s raise input costs unpredictability.

- Meeting stricter environmental regulations and increased demand for recycled or sustainable materials creates pressure on production methods and product formulations, which can increase costs and complicate operations.

Polypropylene Compounds Market Segmentation Insights

Propylene Compounds Insights:

Which Propylene Type Dominated In Propylene Compounds Market?

The homopolymer segment dominated the polypropylene compounds market in 2024, owing to its widespread use in various applications. homopolymers offer a balance of mechanical strength, chemical resistance, and cost-effectiveness, making them suitable for products like automotive parts, packaging materials, and consumer goods. Their versatility and established manufacturing processes contribute to their market dominance. As industries continue to seek reliable and cost-efficient materials, homopolymers remain a preferred choice in the market.

The copolymer segment is expected to grow at the fastest rate in the polypropylene compounds market during the forecast period. Copolymer polypropylene offers enhanced properties such as improved impact resistance, transparency, and possibility, making it suitable for specialized applications in automotive, healthcare and packaging industries. The increasing demand for high performance materials and advancements in copolymerization technologies are driving the growth of this segment. As industries seek materials that meet specific performance criteria, the copolymer segment is poised for significant expansion in the coming years.

Application Type Insights:

Which Application Type Dominates Polypropylene Compounds Market?

The automotive segment dominated the market in 2024. The automotive industry continues to be a significant consumer of polypropylene compounds due to their lightweight nature, cost-effectiveness, and ability to meet stringent performance standards. Polypropylene compounds are used in various automotive components, including interior panels, bumpers, and dashboards, contributing to weight reduction and fuel efficiency. As the automotive industry focuses on sustainability and performance, the demand for polypropylene compounds in this sector remains strong.

The consumer goods segment is projected to experience the highest growth rate in the market between 2025 and 2034. The increasing demand for durable, lightweight, and cost-effective materials in consumer goods is driving this growth. Polypropylene compounds are used in a wide range of consumer products, including appliances, furniture, and personal care items, due to their versatility and performance characteristics. As consumer preferences shift towards sustainable and high-quality products, the demand for polypropylene compounds in this sector is expected to rise significantly.

Property Type Insights:

Which Property Type Dominates In Polypropylene Compounds Market?

The impact resistant segment accounted for a large share of the market in 2024. Impact resistant polypropylene compounds are crucial in applications where durability and resistance to mechanical stress are essential. These compounds are widely used in automotive parts, packaging materials, and consumer goods, where they provide enhanced strength and longevity. The demand for impact resistant materials continues to grow as industries seek products that can withstand harsh conditions and provide long term performance.

The UV resistant segment is anticipated to grow with the highest CAGR over the studied years in the market in the coming years. UV resistant polypropylene compounds are designed to withstand prolonged exposure to ultraviolet light without degrading, making them ideal for outdoor applications such as automotive exteriors, agricultural films, and outdoor furniture. The increasing demand for durable materials that can maintain their appearance and functionality under sunlight exposure is driving the growth of this segment.

Process Technology Insights:

Which Process Technology Dominates In Polypropylene Compounds Market?

The injection molding segment emerged as the top performing process technology in the market in 2024. Injection molding is widely used in the production of complex and high precision components, making it a preferred choice for manufacturing polypropylene based parts in automotive, consumer goods, and packaging industries. The ability to produce intricate designs with high efficiency and repeatability contributes to the dominance of injection moulding in the market.

The extrusion segment is predicted to expand rapidly in the polypropylene compounds market in the coming years. Extrusion is a continuous process that allows to produce long, uniform profiles, making it suitable for applications such as pipes, films, and sheets. The growing demand for lightweight materials in the automotive and packaging sectors is driving the adoption of extrusion technologies for propylene compounds. Advancements in extrusion processes are enabling the production of more complex profiles and improving material properties, contributing to the segment’s rapid growth.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3900) https://www.towardschemandmaterials.com/checkout/5893

Regional Insights

Why Is Asia Pacific Dominating The Polypropylene Compounds Market?

The Asia Pacific polypropylene compounds market size was estimated at USD 9.56 billion in 2024 and is projected to reach USD 20.38 billion by 2034, growing at a CAGR of 7.86% from 2025 to 2034.

Asia Pacific dominated the polypropylene compounds market in 2024. This dominance is driven by rapid industrialization, strong manufacturing bases, and large consumer demand in countries like China, India, Japan and Southeast Asia. The region’s robust automotive, packaging, and electronics sectors contribute to the high demand for polypropylene compounds. Additionally, investments in recycling infrastructure and the adoption of bio based alternatives are addressing environmental concerns, further boosting market growth.

China plays a pivotal role in Asia Pacific polypropylene compounds market, holding a substantial share in 2024. The country’s expansive automotive industry and increasing adoption of electric vehicles drive the demand for polypropylene compounds. Furthermore, China’s growing residential, commercial, and infrastructure development sectors contribute to the widespread use of polypropylene compounds. Government support for clean energy and significant investments in research and development enhance the production capabilities of polypropylene compounds.

Why Is North America The Fastest Growing Region In The Polypropylene Compounds Market?

North America expected to experience rapid growth in the market during the forecast period, driven by the increasing demand for lightweight and durable materials across various industries. The automotive sector, in particularly, is a significant contributor, as manufacturers seek to reduce vehicle weight and improve fuel efficiency. Additionally, advancements in recycling technologies and a growing emphasis on sustainability are encouraging the use of recycled polypropylene compounds. The region’s robust infrastructure and technological innovations further support the expansion of the market.

The United States stands out as a key player in the polypropylene compounds market, accounting for a significant share of the regional demand. The country’s strong automotive industry drives the need for lightweight materials, while the construction and packaging sectors also contribute to market growth. Technological advancements and a focus on innovation enable U.S. manufacturers to produce high quality polypropylene compounds that meet diverse application requirements.

Polypropylene Compounds Market Top Companies

- Braskem: Offers bio-based, circular, and recycled PP; major producer in the Americas; expanding PP capacity in Brazil and the US.

- Total Petrochemicals: Supplies a wide PP portfolio; expanding PP production in Asia; targets packaging and automotive sectors.

- Reliance Industries: India’s leader in circular PP (CircuRepol™); integrates chemical recycling; serves diverse industries.

- Formosa Plastics Corp.: Vertically integrated; produces Formolene® PP; improved supply chain with PDH plant.

- LG Chem: Develops high-performance PP compounds (LUPOL); expanding PCR-PP; strong in automotive materials.

- BASF: Focuses on engineering PP-like alternatives; contributes via specialty compound applications (e.g., automotive).

More Insights in Towards Chemical and Materials:

- Polypropylene Market : The global polypropylene market volume was reached at 87.21 million tons in 2024 and is expected to be worth around 135.05 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.47% over the forecast period 2025 to 2034.

- Recycled Engineering Plastics Market : The global recycled engineering plastics market size was valued at USD 4.85 billion in 2024 and is expected to hit around USD 7.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% over the forecast period from 2025 to 2034.

- Plastic Waste Management Market : The global plastic waste management market size was reached at USD 38.19 Billion in 2024 and is expected to be worth around USD 54.66 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period 2025 to 2034.

- Mechanical Recycling of Plastics Market : The global mechanical recycling of plastics market size was reached at USD 37.85 billion in 2024 and is expected to be worth around USD 92.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.39% over the forecast period 2025 to 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market : The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Plastic Compounding Market : The global plastic compounding market size was reached at USD 72.55 billion in 2024 and is expected to be worth around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- Bio-Based Polypropylene Market : The global bio-based polypropylene market stands at 49.18 kilo tons in 2025 and is forecast to reach 261.27 kilo tons by 2034, advancing at a 20.39% CAGR.

- Green Polypropylene Market : The global green polypropylene market size was valued at USD 22.85 billion in 2024 and is expected to hit around USD 72.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.27% over the forecast period from 2025 to 2034.

- Renewable Polypropylene Market ; The global renewable polypropylene market size was valued at USD 58.85 billion in 2024 and is expected to hit around USD 133.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period from 2025 to 2034.

-

U.S. Polypropylene Market ; The U.S. polypropylene market size was valued at USD 19.70 billion in 2024, grew to USD 20.49 billion in 2025 and is expected to hit around USD 29.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.98% over the forecast period from 2025 to 2034.

Polypropylene Compounds Market Top Key Companies:

- Braskem

- Total Petrochemicals

- Reliance Industries

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company

- BASF

- LG Chem

- China National Petroleum Corporation (CNPC)

- DSM Engineering Plastics

- Clariant

- Arkema Group

- Mitsui Chemicals

- UBE Industries

- Hanwa Chemical Corporation

- PolyOne Corporation (Now Avient Corporation)

- Polyplastics Co. Ltd.

Recent Developments

- In January 2025, India and Finland have entered a collaboration aimed at setting global benchmarks in sustainable packaging practices. This partnerships focuses on addressing the growing demand for recyclable and eco-friendly packaging solutions. With the Indian plastic packaging sector projected o reach $12.72 billion in 2025, this imitative aligns with the need for sustainable and recyclable solutions.

- In June 2025, the Union Government deferred by three months the rollout of mandatory quality control orders (QCOs) for polymer based sacks used in cement packaging 50 kg cement bags and for sorting, transporting, and storing mail and parcels. These sacks are preferred due to their strength, durability and resistance to moisture.

Polypropylene Compounds Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polypropylene Compounds Market

By Type of Polypropylene

- Homopolymer

- Copolymer (Random Copolymer, Block Copolymer)

By Application

- Automotive

- Interior

- Exterior

- Under-the-Hood

- Consumer Goods

- Appliances

- Furniture

- Packaging

- Electrical & Electronics

- Insulation

- Connectors

- Cables

- Medical

- Syringes & Injectables

- Medical Containers

- Diagnostic Devices

- Construction

- Pipes & Fittings

- Flooring

- Insulation

- Packaging

- Rigid Packaging

- Flexible Packaging

- Textiles

- Nonwoven Fabrics

- Carpet Backing

- Apparel

- Others

- Agriculture Films

- Industrial Products

By Property

- Flame Retardant

- Impact Resistant

- UV Resistant

- Antistatic

By Process Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive

USD 3900) https://www.towardschemandmaterials.com/checkout/5893

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.